Will Gold Price Fall? A Forecast and Analysis

1. Recent Trends & Current Context

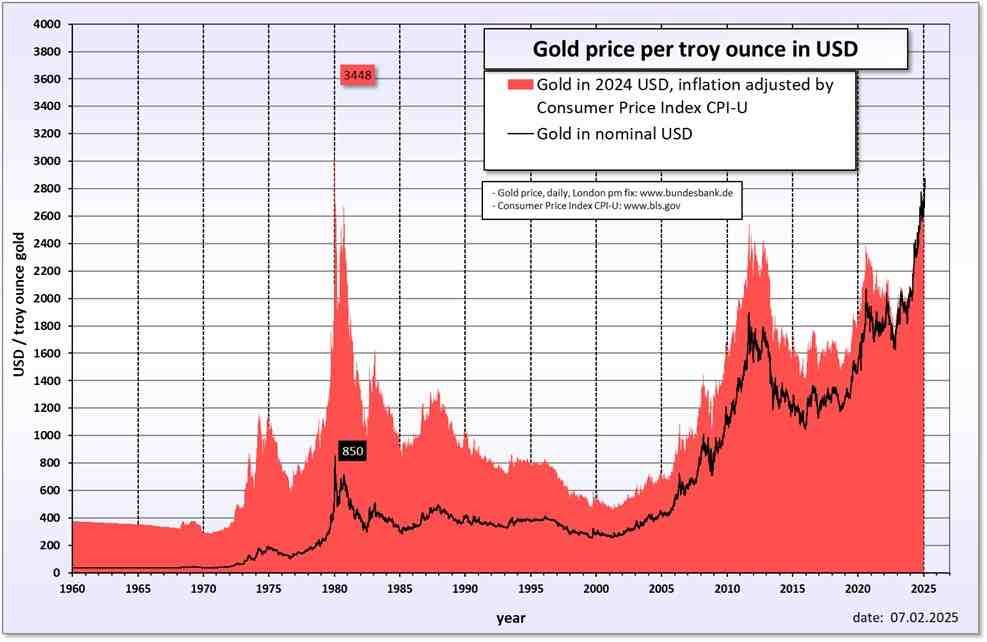

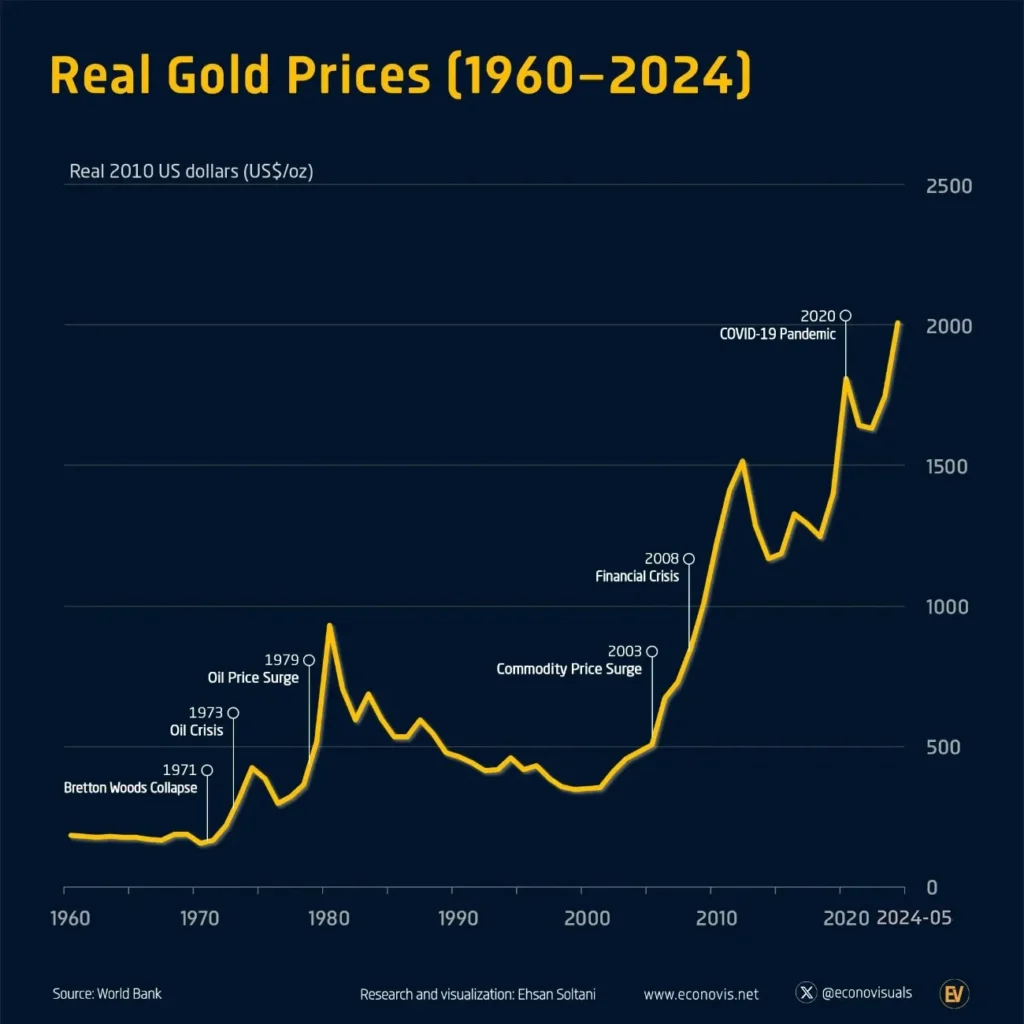

- Gold has already seen a dramatic run in 2025, with prices breaking previous records.

- Many analysts believe gold still has room to go higher, especially if key supporting factors remain in place.

- But the path upward is not guaranteed; downside risks are real if some factors shift.

So, will gold fall? It might, in the short term or on corrections — but the baseline expectation among many is for continued upside bias, with periods of pullback. The rest of the article explores which forces could push it up or down, and what the most likely scenarios look like.

2. Key Drivers: Demand, Supply & Inventories

Demand Side Forces

- Investment Demand / Safe-Haven Flows

- In uncertain times, investors flock to gold. Geopolitical risk, financial stress, inflation concerns all boost this demand. World Gold Council+3GoldSilver+3

- Exchange-traded funds (ETFs) and institutional allocations amplify flows. When momentum is strong, inflows can feed further gains.

- Central Bank Purchases / Reserve Diversification

- Many central banks have been adding gold to diversify foreign reserves away from just holding U.S. Treasuries or dollar assets.

- This is a structural form of demand less sensitive to short-term market swings.

- Jewelry & Industrial / Technology Demand

- In core markets (India, China), demand for jewelry remains a major driver.

- Use in electronics, medical devices, etc. – though that portion of demand is relatively modest compared to investment + central bank demand.

- Speculation / Momentum & Trader Flows

- Sentiment, technical trends, momentum trading can exaggerate upswings or downswings.

Supply Side Forces

- Mine Production / New Discoveries

- Gold is a slow-growing supply commodity. New mining capacity takes years, so supply is relatively inelastic in the short term.

- In many mature mining regions, new major discoveries are rare, so supply growth is constrained.

- Recycling / Secondary Supply

- Old jewelry, scrap gold, central bank sell-offs (if they occur) feed supply.

- If prices are high, recycling increases as people sell. This can act as a modest “brake” on further rise.

- Costs of Production / Energy, Inputs

- If extraction costs (energy, labor, environmental compliance) increase, that raises marginal cost of new supply.

- In remote or difficult geographies, higher input costs can constrain output.

- Inventory / Stock Piles

- Physical reserves held by central banks, sovereign wealth funds, or private vaults matter.

- If these reserves are unlocked (i.e. sold) in volumes, it could add downward pressure; conversely, hoarding helps support pricing.

3. Geopolitical & Macro Risks

These are often catalysts for sharp moves:

- Wars / Conflicts / Sanctions

Tensions in the Middle East, Eastern Europe, Taiwan, supply chokepoints, or sanctions can push safe-haven demand. - Trade Wars / Tariffs / De-globalization

Disruptions to trade, capital flows, or supply chains raise risks, boost uncertainty, and often favor gold. - Currency Regime Shifts / De-dollarization

Moves by countries to shift reserve strategy away from the U.S. dollar or diversify currencies can benefit gold. - Sovereign Debt Crises / Fiscal Stress

When governments face rising debt, default risk, currency pressure — gold becomes more attractive.

In short: if geopolitical or macro stress rises, gold tends to benefit strongly. But if global calm returns, the pressure might ease.

4. Interest Rates, Fed Policy & Real Rates

This is among the most powerful levers influencing gold.

Mechanisms

- Gold yields no interest. So when interest rates / yields rise, holding gold becomes more “expensive” in opportunity cost compared to interest-bearing assets.

- Real interest rates (nominal rates minus inflation) are more relevant: even if nominal rates are high, if inflation is high, real rates might be low or negative — favorable for gold.

- Moves in the U.S. Federal Reserve’s policy (cutting, pausing, or hiking) shift expectations and thus capital flows to/from gold.

2025 and Forward Expectations

- Markets currently price in two more Fed rate cuts in 2025.

- Many analysts expect gold to average $3,675/oz by late 2025, and perhaps test $4,000/oz by mid-2026.

- UBS sees gold reaching ~$3,800 by end-2025.

- A stronger-than-expected U.S. economy or stickier inflation could lead the Fed to delay cuts or even re-raise — that scenario would put pressure on gold.

Thus, gold’s near-term direction very much hinges on how dovish or hawkish the Fed ends up being, and whether inflation surprises upward or downward.

5. Other Factors: Dollar, Inflation, Sentiment

U.S. Dollar Strength / Weakness

- Gold is priced in USD. A weaker dollar makes gold more affordable for foreign buyers, boosting demand.

- Conversely, a stronger dollar can suppress gold.

- In 2025, dollar weakness has been one key driver of gold’s rally. I

Inflation & Inflation Expectations

- Gold is often viewed as an inflation hedge or “store of value.” If inflation remains elevated (or resurges), gold interest increases.

- If inflation falls faster than expected, real rates may rise, which could be a headwind for gold.

Market Sentiment, Momentum & Technicals

- Breakout above key resistance levels or momentum flows can attract new buyers, driving further gains.

- But sentiment can reverse sharply on surprises (e.g. economic data, Fed surprises).

- Technical corrections are likely, even if the overall trend is upward.

6. Forecast Scenarios: Upside, Base, and Downside Cases

Here’s a tabular view of possible scenarios:

| Scenario | Description / Conditions | Likely Gold Range / Behavior | Risks & Headwinds |

|---|---|---|---|

| Bull / Upside | Fed cuts aggressively, inflation remains sticky, geopolitical turmoil, central banks keep buying | $4,200 – $5,000+ / oz by late 2025–2026 (HSBC expects $5,000) Reuters | Over-extension, profit-taking, dollar rebound |

| Base / Moderate Uptrend | Fed cuts modestly, inflation gradually falls, but macro risks linger | $3,500 – $4,200 / oz with occasional pullbacks | Strong data derails rate cuts, dollar stabilizes, weaker sentiment |

| Down / Correction | Strong economic rebound, inflation falls below expectations, Fed pauses or hikes | Correction to $3,000 – $3,400 / oz or steeper | Policy surprise, capital rotation to equities, central bank rotation |

Many analysts lean closer to the base-to-bull scenario, with caution around possible corrections.

For example:

- J.P. Morgan sees ~$3,675 late 2025 and potential move toward $4,000 mid-2026.

- UBS forecasts ~$3,800 by end-2025. GoldSilver

- HSBC has raised forecasts, citing tailwinds from uncertainty, debt, central banks, and expecting continued volatility.

- Some commentators warn of near-term correction risk if Fed communication surprises hawkishly or data is stronger.

7. Will Gold Fall? When & Why It Might

Gold could fall — especially in certain scenarios. Key triggers for downward pressure might include:

- Surprisingly strong U.S. economic data (jobs, GDP, manufacturing) that defies expectations, pushing Fed to stay hawkish or delay cuts.

- Inflation easing faster than expected, raising real rates.

- Dollar rebound due to capital flows, risk-on sentiment, or policy shifts.

- Profit-taking / momentum reversal after a sharp run-up.

- Less central bank buying or even selling of gold reserves.

- Improved geopolitical climate (less conflict, less trade tension) reducing safe-haven demand.

So in short: a pullback or correction is plausible, especially in the short to medium term, but a full collapse below long-term support seems less probable unless multiple strong negative triggers align.

8. My Base Case Forecast & Timeline

Putting all of this together, here’s a plausible path I see:

- Remainder of 2025: Gold may oscillate between $3,600 and $4,300 with a continuing upward trend. Occasional dips as markets digest Fed signals or macro data.

- Mid-2026: If multiple Fed cuts materialize, geopolitical unrest persists, and inflation remains sticky, gold could test $4,500 – $5,000 (as some bullish forecasts suggest).

- Beyond 2026: Growth in gold depends on structural adoption (reserves, institutional allocations, de-dollarization trends), plus whether supply constraints intensify.

So “will gold fall?” — yes, likely in short-term intervals. But I expect the overall trend in medium term to remain upward or sideways-to-up, provided supporting conditions hold.

9. Key Risks to Monitor (What Could Reverse the Trend)

- U.S. economic resilience strong enough to force hawkish monetary policy

- Significant reversal in dollar weakness

- Sudden drop in inflation expectations

- Central banks reducing gold purchases or even selling

- Liquidity crunch or risk-off causing capital flight from all assets

- Technological or policy shifts reducing gold’s appeal

Investors should monitor Fed statements, inflation data, economic surprises, geopolitical events, and central bank buying trends closely.

10. Conclusion

Gold is at an important inflection point. On one hand, many forces — expected Fed rate cuts, inflation fears, geopolitical instability, central bank demand — favor further gains. On the other hand, the precious metal is not immune to pullbacks, especially if macro surprises tilt the balance.

So while a short-term fall or correction is entirely possible, I lean toward a scenario where gold continues to drift upward over the next 12–18 months, with volatility along the way.

For more articles click here

- How to Download Your Telangana Family Member Certificate Soft Copy (FMC)

- Top 5 Indian Cities to Buy Property in 2025: Investment & Growth Guide

- 100+ Unique Anniversary Wishes for Everyone You Know

- Top 15 Best Indian Social Media & AI Apps (2025): Revolutionizing Bharat’s Digital Future

- 1000+ Happy Birthday Wishes for Everyone in Your Life