Top 5 Indian Cities to Buy Property in 2025: Investment & Growth Guide

Making a property investment is one of the most significant financial decisions you can make. The Indian real estate market, known for its dynamic nature, is poised for significant growth, driven by rapid urbanization, infrastructure development, and a strong economy. Choosing the right city to invest in is crucial for maximizing returns, whether you’re looking for long-term appreciation or steady rental income.

This guide explores the best cities to buy property in India for 2025. We analyze key markets based on their economic growth, infrastructure projects, affordability, and rental yields. By providing data-driven insights, we aim to help you make an informed decision for your next property investment.

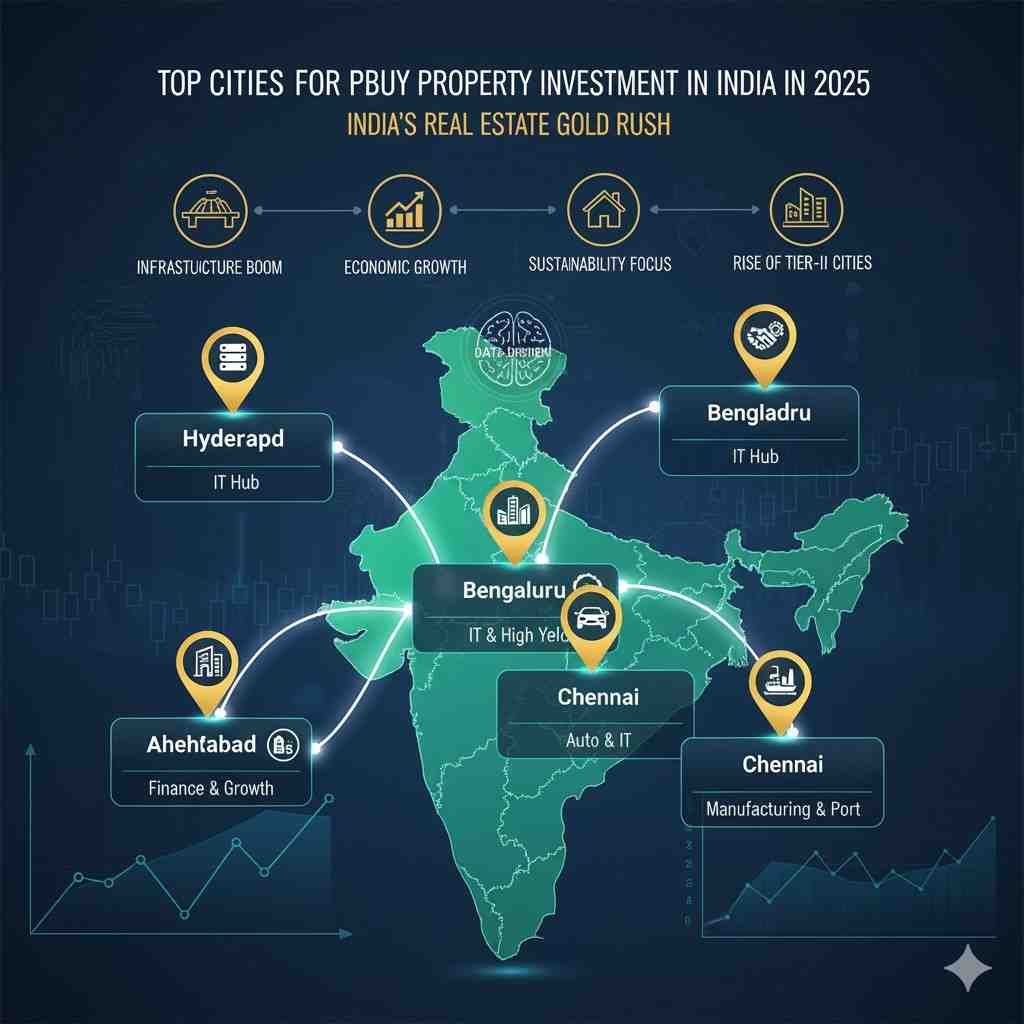

Key Factors Driving Real Estate Growth in 2025

Before diving into specific cities, it’s important to understand the trends shaping the market and driving investor confidence:

- Infrastructure Boom: The government’s continued focus on developing highways, metro lines, airports, and industrial corridors is unlocking new real estate micro-markets and dramatically improving connectivity, which directly translates to capital appreciation.

- Rise of Tier-II Cities: As major metros become saturated and expensive, Tier-II cities are emerging as attractive investment destinations, offering superior affordability and high growth potential for first-time investors.

- Economic & Employment Growth: A stable economy and a burgeoning IT and manufacturing sector are consistently creating high-income jobs, which in turn fuels organic demand for quality housing and rental properties.

- Focus on Sustainability: Modern homebuyers are increasingly looking for green buildings and integrated townships that prioritize community, convenience, and a better quality of life over mere location.

The Top Cities for Property Investment in 2025

Here is our analysis of the most promising cities for real estate investment in India for the coming year.

1. Hyderabad, Telangana

Hyderabad continues its reign as a top real estate destination, offering a perfect blend of robust infrastructure, a booming IT sector, and relative affordability compared to other major metros.

Why Invest in Hyderabad?

- IT and Pharma Hub: The city is a major employment center, home to global giants like Google, Amazon, and Microsoft, along with a thriving pharmaceutical industry. This ensures a consistent demand for both rental and residential properties.

- Infrastructure Development: The expansion of the Outer Ring Road (ORR), the upcoming Regional Ring Road (RRR), and the continuous growth of the metro network are enhancing connectivity. The development of the “Pharma City” is set to create even more jobs in the near future.

- Growth Corridors: Areas along the IT corridor in West Hyderabad, such as Gachibowli, Kokapet, and Narsingi, continue to see high appreciation. East Hyderabad, including areas like Uppal and Adibatla, is emerging as the next growth zone due to government focus and infrastructure projects.

- Quality of Life: Hyderabad consistently ranks high in quality of life surveys, offering excellent social infrastructure and a cosmopolitan culture.

2. Bengaluru, Karnataka

Despite being a mature market, Bengaluru, the “Silicon Valley of India,” remains one of the best cities for real estate due to its resilient IT-driven economy and massive talent pool.

Why Invest in Bengaluru?

- Unmatched IT Dominance: As India’s primary IT and startup hub, Bengaluru has a high-income population that creates sustained demand for premium and mid-segment housing, making it a resilient market during economic shifts.

- Major Infrastructure Upgrades: The ongoing expansion of the Namma Metro, the development of the Peripheral Ring Road (PRR), and the new terminal at Kempegowda International Airport are set to ease congestion and boost real estate values in connected areas.

- High-Growth Micro-Markets: North Bengaluru, particularly areas near the airport like Devanahalli and Yelahanka, is a hotspot for long-term investment. Whitefield and Sarjapur Road in the east remain popular due to their proximity to established IT parks.

- Strong Rental Yields: The constant influx of professionals ensures that Bengaluru offers some of the country’s strongest rental yields, providing reliable steady income for investors.

3. Pune, Maharashtra

Pune has transformed from a quiet educational town into a bustling IT and manufacturing hub. Its proximity to Mumbai, coupled with its excellent quality of life, makes it a highly attractive destination for property investment in 2025.

Why Invest in Pune?

- Diversified Economy: Pune has a robust presence across the IT, automotive, and manufacturing sectors. This economic diversity provides inherent stability to its real estate market, cushioning it from sectoral downturns.

- Rapid Infrastructure Growth: The development of the Pune Metro, the Ring Road project, and the planned new international airport at Purandar will significantly enhance the city’s infrastructure and unlock new areas for development.

- Emerging Corridors: The western corridors of Hinjawadi and Wakad continue to be prime areas due to the IT parks. In the east, Kharadi and Wagholi are witnessing rapid growth, driven by their proximity to IT hubs and industrial zones.

- Affordability & Lifestyle: Compared to Mumbai, Pune offers a more affordable yet high-quality lifestyle, attracting both young professionals and established families. This makes it a balanced market for both capital appreciation and rental returns.

4. Ahmedabad, Gujarat

Ahmedabad is rapidly emerging as a real estate powerhouse, thanks to proactive governance, superb infrastructure, and its status as a key commercial hub.

Why Invest in Ahmedabad?

- Strategic Infrastructure: The development of the GIFT City (Gujarat International Finance Tec-City), the Ahmedabad-Dholera Expressway, and the expansion of the metro are transforming Ahmedabad into a future global financial and IT hub.

- Industrial and Commercial Growth: The city is a major center for textiles, chemicals, and now, finance and technology. This diversified economic activity is creating a surge in housing demand from a growing white-collar workforce.

- Affordable Investment: Property prices in Ahmedabad are still significantly lower than in Mumbai or Delhi, offering a higher potential for capital appreciation on a smaller initial investment.

- High-Growth Zones: The SG Highway corridor and areas around GIFT City are prime locations for future appreciation. West Ahmedabad, including areas like Bopal and South Bopal, is also seeing strong residential demand due to its well-developed social infrastructure.

5. Chennai, Tamil Nadu

Chennai’s real estate market is renowned for its stability and is now entering a new phase of accelerated growth, driven by its strong manufacturing base and expanding IT sector.

Why Invest in Chennai?

- Manufacturing and IT Powerhouse: As a major automobile and manufacturing hub (often called the “Detroit of Asia”), Chennai has a strong industrial economy. The IT sector along the OMR (Old Mahabalipuram Road) corridor continues to expand, providing consistent employment demand.

- Infrastructure Push: The expansion of the Chennai Metro, the development of the Chennai-Bengaluru Industrial Corridor, and the proposed second airport will significantly boost connectivity and real estate activity in suburban areas.

- Resilient Market: Chennai’s property market is less volatile and speculative compared to other metros, showing steady and sustainable growth year-on-year. This makes it a relatively safe market for long-term investors.

- Key Investment Areas: The OMR and GST Road corridors remain the top choices for investment. Areas like Perumbakkam and Siruseri offer a mix of affordable and mid-segment options with strong future growth potential due to commercial proximity.

Conclusion: Making Your Investment Decision in 2025

The Indian real estate market in 2025 offers a wealth of opportunities for savvy investors. While established metros like Bengaluru and Pune continue to deliver reliable returns and rental yields, high-growth cities like Hyderabad and Ahmedabad are providing a compelling mix of affordability and high potential for capital appreciation driven by major government infrastructure projects.

Your final decision should align with your financial goals, risk appetite, and investment horizon. By focusing on areas with strong economic drivers and planned infrastructure development, you can make a property investment that secures your financial future for years to come. The time to invest is now, before the next wave of infrastructure growth fully crystallizes property values.

For more articles click here

- Digital India: Identify Your Land Survey Number Instantly Using Your Smartphone

- AI in Farming: How Indian Farmers Are Transforming Agriculture

- Best Winter Crops for Export From India

- Dhaincha Farming Guide: Save 50% on Urea & Improve Soil Health

- Fertilizer Booking App Guide: How to Book Urea Online