“Closing bell-Nse & Bse market today”

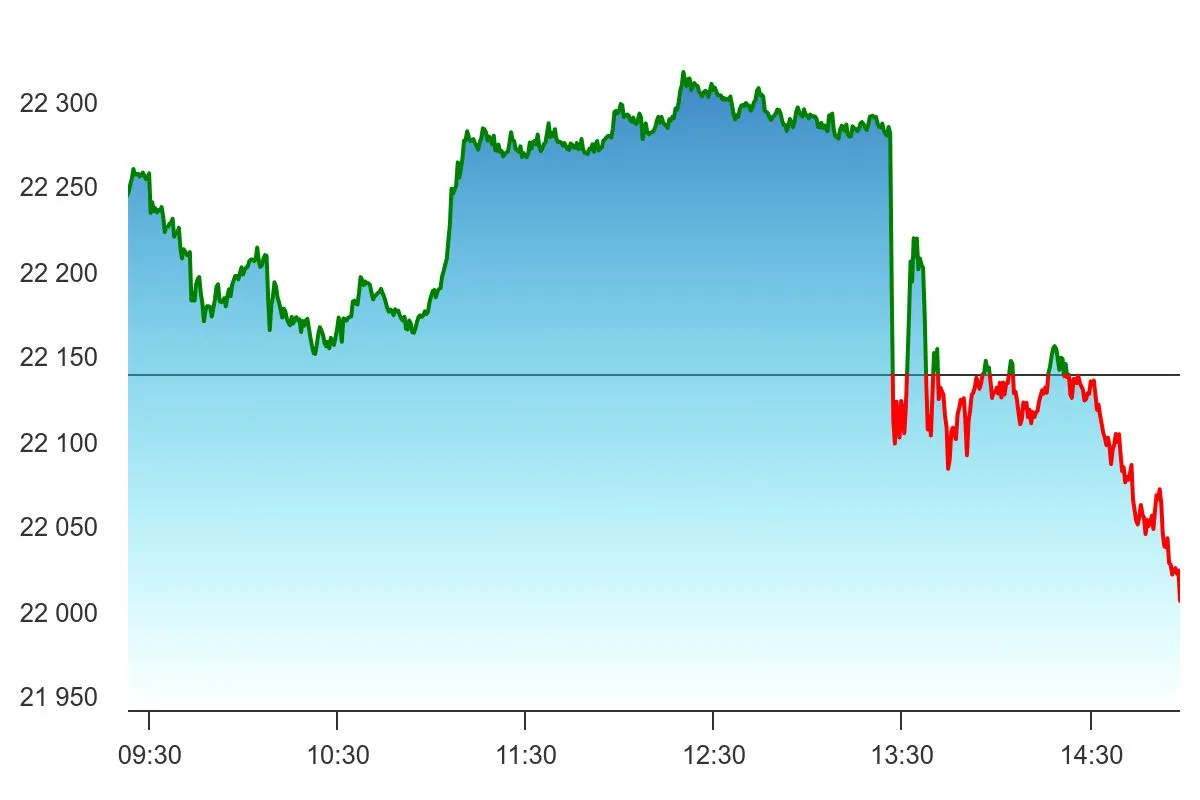

The Indian equity market witnessed a tumultuous trading day on April 18, characterized by high volatility and significant declines. Despite opening on a positive note, both the Nifty and Sensex struggled to maintain momentum, ultimately closing lower for the fourth consecutive session.

Analysis of the Closing Figures

At the close of trading, the Sensex recorded a decline of 454.69 points, representing a decrease of 0.62 percent, settling at 72,488.99. Similarly, the Nifty ended the day down by 152.10 points, or 0.69 percent, closing at 21,995.80.

Factors Contributing to Market Volatility

Several factors contributed to the market’s erratic behavior during the session. Concerns over rising inflation, global geopolitical tensions, and uncertainty surrounding the economic recovery played significant roles in triggering investor apprehension and market volatility.

Impact on Various Sectors

The downturn in the equity indices was led by declines in key sectors such as banking, FMCG, and oil & gas. Banking stocks faced pressure due to concerns over asset quality and the impact of rising interest rates on loan portfolios. FMCG companies witnessed a slowdown in consumer demand amid inflationary pressures, while oil & gas stocks were weighed down by fluctuations in global crude oil prices.

Investor Sentiment

The volatile market conditions dampened investor sentiment, with many adopting a cautious approach towards equities. Risk aversion was evident as investors sought refuge in safe-haven assets such as gold and government bonds.

Key Takeaways for Investors

In light of the prevailing market volatility, investors are advised to exercise prudence and maintain a diversified portfolio. Long-term investment strategies, focusing on quality stocks with strong fundamentals, can help mitigate risks and navigate turbulent market conditions.

Expert Opinions

Market experts express mixed views on the day’s events. While some remain optimistic about the market’s resilience and growth potential, others caution against overlooking underlying risks and urge investors to remain vigilant.

Future Outlook

Looking ahead, market participants anticipate continued volatility in the near term, driven by ongoing macroeconomic uncertainties and geopolitical developments. However, prospects for the Indian equity market remain promising, supported by favorable long-term fundamentals and structural reforms.

Conclusion

The closing bell on April 18 signaled another challenging day for the Indian equity market, marked by widespread declines and heightened volatility. While short-term headwinds persist, investors are reminded of the importance of maintaining a disciplined approach and focusing on the long-term horizon amidst market fluctuations.

FAQs (Frequently Asked Questions)

- Q: What caused the decline in the Indian equity market on April 18?

- A: The market downturn was influenced by various factors, including concerns over inflation, global tensions, and economic uncertainty.

- Q: Which sectors were most affected by the market decline?

- A: Banking, FMCG, and oil & gas sectors experienced significant declines during the trading session.

- Q: How should investors navigate the current market conditions?

- A: Investors are advised to maintain a diversified portfolio and focus on quality stocks with strong fundamentals.

- Q: What are the key takeaways for investors from the day’s events?

- A: Prudence, caution, and a long-term perspective are essential for investors navigating volatile market conditions.

- Q: What is the outlook for the Indian equity market in the coming days?

- A: While short-term volatility may persist, the market’s long-term prospects remain favorable, supported by structural reforms and economic resilience.

see more articles